Understanding the Insurance Billing Process for Electronic Healthcare Records

The Context

In the United States, approximately 50% of therapists accept insurance for their services.

However, the insurance billing system presents numerous challenges, leading some practitioners to forgo insurance acceptance altogether. Common issues include low reimbursement rates, delayed payments, and complex documentation requirements. These hurdles can result in financial strain for therapists and restricted access to care for patients.

The Opportunity

We saw an opportunity to expand our user base and our Electronic Healthcare Record (EHR) platform by including insurance billing and addressing the needs of therapists navigating it. The aim was to reduce administrative burden and make it easier for more therapists to accept insurance.

However, we first needed to understand the insurance billing ecosystem before the decision to pivot into it.

The Team

Product Design: Me (Research, Strategy, Design)

Software Engineering: Boubaker Kalafat

Clinical Lead: Alejandro Serano Saunders

CEO: Joel Stephano

Research Objectives

Map the end-to-end insurance billing process and assess technical challenges;

Identify key third-party services and their integration points;

Provide insights to support a pivoting decision.

Research Approach

Research Methods

Given budget constraints, I could not conduct primary research by interviewing specialists like insurance consultants, billing coordinators, or healthcare administrators. That would have been the ideal way to get firsthand insights, but since that wasn’t an option, I focused first on secondary research to map out the insurance billing process and intended to find opportunities for improvement at a later stage. My goal was to build a clear, structured understanding before diving into common pain points, however, on the way many issues became visible.

Reviewing policies and reports – I went through official guidelines and reimbursement rules to break down the claim submission process. This helped clarify documentation requirements, procedural steps, and insurer-specific differences.

Analyzing competitor solutions – I explored how other platforms handle billing, looking at their workflows, automation features, and usability. This gave me insight into industry standards and where existing systems may fall short.

Exploring forums and discussion groups – Since I couldn’t conduct interviews, I turned to therapist communities, forums, and social media groups to understand some of the frustrations. Common themes included confusing insurance codes, changing regulations, reimbursement delays, and overall a consensus on insurance billing being perceived as a massive black box. However, even though these issues stayed with me at all times, my focus was on firstly understanding the process and secondarily understanding its flaws.

Mixing Research with Experimentation

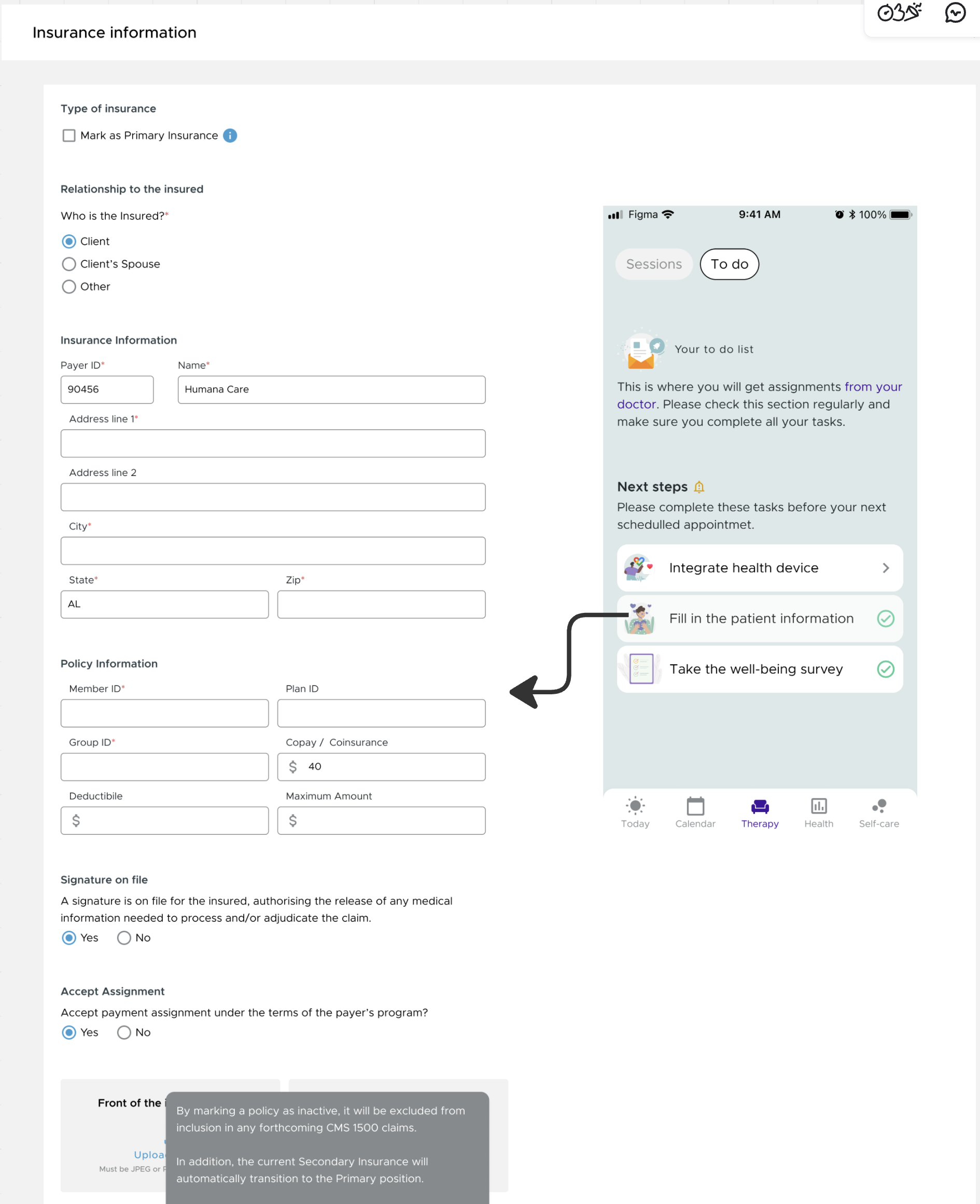

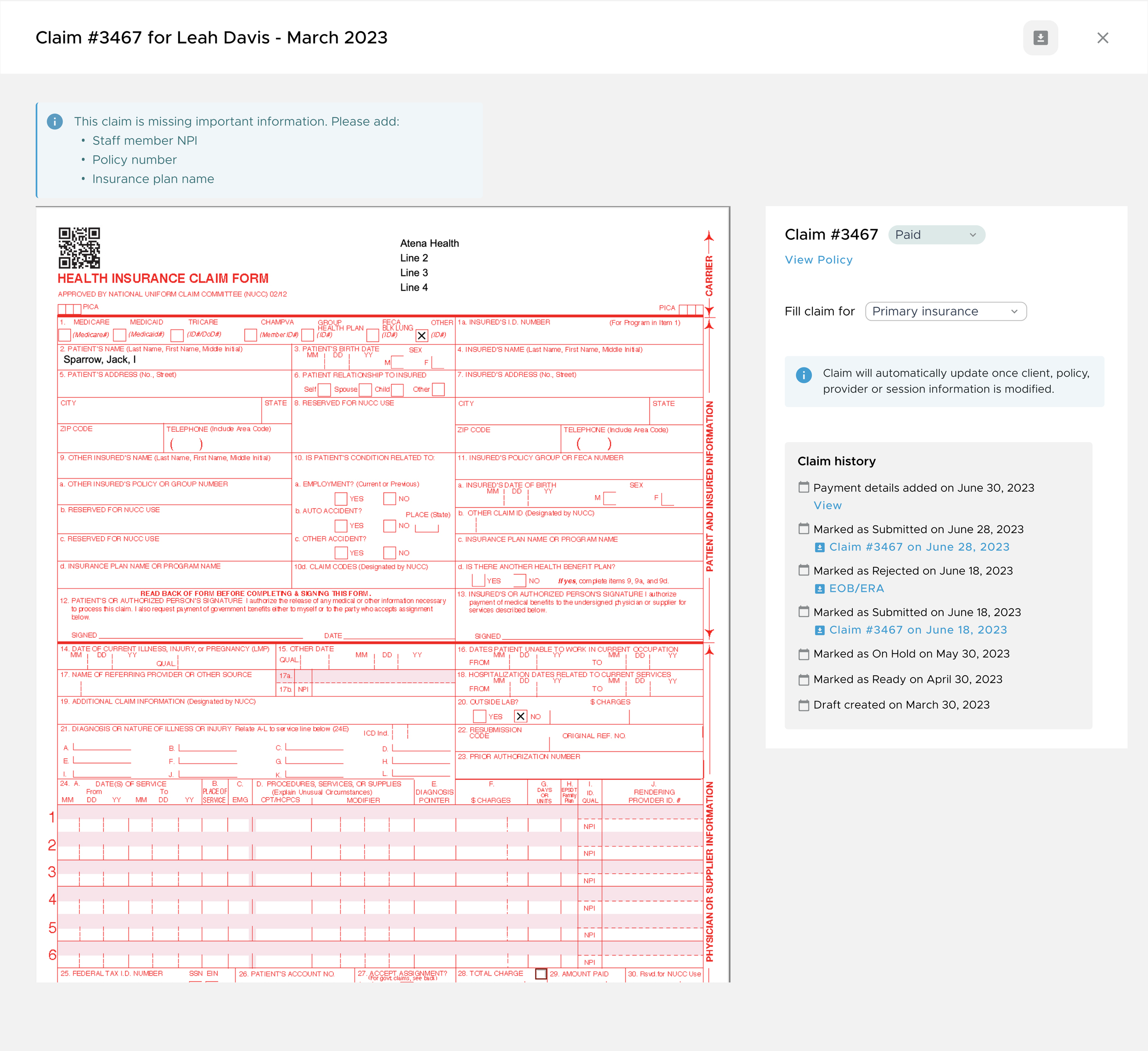

To better understand the technical challenges, I created flows and wireframes to break down each step a therapist takes. This helped me make sense of the process and visually communicate with the team why it might be such a challenging direction to take.

System Mapping – I visualized the full insurance claim cycle, from therapist enrollment to payment reconciliation. This gave me a bird’s-eye view of the entire process and helped me identify which steps we could realistically implement.

Process Flows – I mapped out each tiny step therapists take. To get into the nitty-gritty, I imagined how the solution might work if we were to implement it. I created messy wireframes to spot where small details could turn into major challenges.

Wireframes & Conceptual Designs – To communicate the complexity to my team, I designed high-fidelity screens for some key parts of the process. These were easier to follow than messy wireframes and gave a clear idea of the development effort required. The designs weren’t meant to be final UX/UI solutions—just a way to show what a possible implementation might look like.

Even without direct interviews, this research provided a solid foundation for identifying challenges and helping us understand insurance billing as a team.

Insurance Billing: 3 Steps

To structure the process and identify opportunities for improvement, I mapped out the insurance process into three essential stages:

Therapist Enrollment with the Insurance Company- Credentialing, contracting, and gaining approval to bill insurers.

Checking Insurance Eligibility & Submitting the Claim - Verifying a client’s coverage, co-pays, deductibles, and coordination of benefits and completing the claim form, coding sessions correctly, and sending claims to insurance.

Receiving the Insurance Response - Handling reimbursements, denials, and appeals based on Explanation of Benefits (EOBs).

Each of these stages presents unique challenges, and in the following sections, I will break them down individually—exploring what the process entails, the obstacles therapists face, and some recommendations to streamline each step.

Enrollment Process Key Terms

Credentialing – The process of verifying a therapist’s qualifications and approving them to bill an insurance company.Contracting – The process of signing an agreement with an insurance company to become an in-network provider.In-network provider – A therapist who has a contract with an insurance company to offer services at negotiated rates.Out-of-network provider – A therapist who does not have a contract with the insurer and may result in higher costs for the client.Provider number (NPI - National Provider Identifier) – A unique 10-digit number assigned to healthcare providers for billing.Taxonomy code – A code identifying a provider’s specialty (eg. mental health counseling, social work).CAQH (Council for Affordable Quality Healthcare) – A database where providers store credentialing information for insurers to access.Paneling – When an insurance company accepts a therapist into their provider network.

Step 1: Therapist Enrols with the Insurance Company

How It’s Done

Before therapists can submit claims, they need to enrol with insurance providers. This involves credentialing, contracting, and obtaining a provider number - a process that can take months. Each insurer has different network requirements, making it challenging for therapists to join multiple plans. Tracking application progress is difficult, as insurers provide little communication along the way.

Main Challenges

Credentialing and contracting are slow, often taking months to complete.

Most API-based billing solutions do not include credentialing and contracting, as these are typically handled separately by therapists.

Therapists struggle to track their application status due to poor communication from insurers.

Different insurers have different requirements, making the process even more confusing.

Recommendations

Because most API billing systems do not include credentialing and contracting we might need to exclude support in this area.

We still need a national database of insurance providers to help therapists enroll with the right companies for billing management.

Building a state-by-state database is a massive challenge, so a better move would be to integrate with third-party APIs that handle provider enrollment, like eligible.com or enter.health.

Once the therapist becomes an in-network provider, we can enrol them with the insurance company so they can start the claim process through our system.

Eligibility & Claim Key Terms:

Coordination of Benefits (COB) – The rules determining which insurer pays first when a client has multiple plans.Primary insurance – The first insurance plan responsible for paying claims.Secondary insurance – A backup insurance plan that may cover remaining costs after the primary insurance pays.Deductible – The amount a client must pay out-of-pocket before insurance starts covering services.Co-pay – A fixed fee the client pays for each therapy session, regardless of the total cost.Co-insurance – The percentage of costs the client is responsible for after meeting the deductible.Out-of-pocket maximum – The total amount a client has to pay before insurance covers 100% of costs.Pre-authorization – Approval from the insurance company before certain services can be provided and reimbursed.Superbill – A detailed receipt a therapist provides to out-of-network clients to submit for reimbursement.CMS-1500 form – The standard form used to submit insurance claims for outpatient services.Clearinghouse – A third-party service that checks claims for errors before forwarding them to insurance companies.EDI (Electronic Data Interchange) – The electronic system used to submit insurance claims.CPT (Current Procedural Terminology) codes – Codes used to describe the therapy services provided (e.g., 90837 for a 60-minute session).ICD-10 codes - Diagnostic codes required for insurance billing (e.g., F32.1 for major depressive disorder).Modifier codes – Additional codes that specify details about the service (e.g., “95” for telehealth sessions).

Step 2: Therapist Checks Insurance Eligibility & Submits the Claim

How It’s Done

Once the client’s insurance details are collected, therapists need to verify eligibility. This means checking whether mental health services are covered, confirming co-pays, and understanding out-of-pocket costs. Most do this by logging into the insurer’s portal or calling their verification line. If a client has multiple insurance plans, the therapist must also determine which one is primary.

The CMS-1500 form is used to submit claims for reimbursement, but completing it correctly is a major challenge. Claims can be submitted electronically through an EHR system, other specialized services, or directly on the insurance provider’s portal. Clearinghouses check for basic errors before forwarding claims to the insurer.

This represents the main stage of insurance claiming and comprises of many challenges.

Main Challenges

Clients may provide incomplete or outdated insurance details, leading to claim denials.

Many don’t understand their own coverage, leaving therapists to figure out deductibles, co-pays, and limitations.

Some clients often forget to inform therapists about policy changes, meaning services may be provided without coverage.

Insurance verification can be time-consuming, often requiring long calls or multiple logins.

Clients with high deductibles may have to pay out of pocket until their deductible is met, which can cause confusion.

Coordination of Benefits (COB) rules are complex, making it hard to know which insurer pays first.

Completing the CMS-1500 form manually is time-consuming and increases the risk of errors.

Each insurer has different claim requirements, making compliance difficult.

Small mistakes, such as incorrect patient details or diagnosis codes, can lead to claim rejections.

Therapists often face long waiting periods for reimbursements due to administrative bottlenecks.

If a claim is denied, the appeals process requires additional effort and further delays payment.

Recommendations

Make use of our Patient App to prompt clients to upload and update their insurance info.

Instantly check if a client’s insurance is valid and what’s covered (solution covered by the API)

Use the API to determine the COB and establish between Primary and Secondary Insurance to determine which insurance pays first.

Eligibility checks are usually done before the first session - it would be a better practice to automate a regular check and inform therapists ahead of time about coming changes so they can ensure that services are covered.

Help therapists to split the invoice between the client and the insurance company by tracking deductibles and out-of-pocket in real time.

Pre-fill CMS-1500 forms using existing client and session data to reduce errors and speed up submission.

Offer additional information for each CMS-1500 input box to make completion easier for new therapists.

Implement a verification system that flags missing or incorrect fields before submission, lowering rejection rates.

Automate claim submissions and enable therapists to track claim status within the platform (through the API).

Some of the messy work involved

Processing the Claim Key Terms: Explanation of Benefits (EOB) – A document from the insurer explaining how a claim was processed and paid.Electronic Remittance Advice (ERA) – A digital version of the EOB used by billing software.Allowed amount – The amount the insurer agrees to pay for a service.Denial code – A code indicating why a claim was rejected (e.g., missing information, expired authorization).Reimbursement rate – The percentage of the allowable amount that the insurance company will pay.Claim rejection – When a claim is sent back due to missing information before processing.Claim denial – When a claim is processed but not paid, often due to coverage issues.Resubmission – Sending a corrected claim after a rejection or denial.Appeal – A request for the insurance company to reconsider a denied claim.

Step 3: Therapist Gets a Response from the Insurance

How it’s done

Once the claim is processed, the therapist receives an Explanation of Benefits (EOB) or an Electronic Remittance Advice (ERA). These documents explain whether the claim was approved, denied, or partially paid. If denied, therapists must correct the claim or submit an appeal with additional documentation.

Main Challenges

Processing times vary, leaving therapists unsure when they’ll be paid.

EOBs and ERAs are often difficult to read, referencing the insurance's small print, making it unclear why a claim was denied.

Filing appeals is time-consuming and requires gathering extra paperwork.

If insurance doesn’t cover the full amount, therapists must chase clients for payment.

Recommendations

Real-time updates on claim status so therapists know when to expect payments.

Clear UI design for the ERA/EOB form to explain what was covered and what still needs to be paid (if the API offers structured data rather than a document output)

Automatically update client invoices based on insurance payments to ease the manual work of editing invoices.

Notify clients of outstanding balances and facilitate direct payments through the Patient App.

Final Outcomes

The research revealed just how complex insurance billing is - integrations, real-time eligibility checks, and accurate coding, all require ongoing maintenance and compliance. The challenges quickly became clear:

Insurance billing is a massive undertaking – Secure integrations, real-time eligibility checks, and accurate coding require a dedicated team to ensure compliance and prevent costly errors. Also, insurance policies change constantly, which means any billing feature would require ongoing updates and customer support.

Building it ourselves wasn’t feasible - The cost of developing, maintaining, and scaling a billing solution would have outweighed its short-term benefits, even by integrating an API.

Competition is tough – We needed more systematic research into other EHRs to be able to offer a valuable differentiation. While integrating insurance as proposed in my recomendations wouldn’t necessarily set us apart, it would align us with industry standards and improve the overall therapist experience.

Therapists stick to what they know - Even though many EHR billing systems are outdated and present clunky UI, they still remain the familiar choice, and switching is a hassle therapists aren’t eager to take on.

API solutions weren’t an easy fix - Relying on a third-party API wasn’t as simple as plugging it in. I reached out to Eligible and Enter to explore possible integrations. One never responded (even after I messaged the founder directly), and the other required a minimum number of active clients before offering access—something we didn’t have at the time.

A lightweight solution was still possible - While full billing automation wasn’t realistic, we found a small win in streamlining the CMS-1500 form to reduce manual errors and save therapists time. This would mean helping therpaists fill in the claim form which they can downlad and submit through a dedicated service or directly to insurance.

While we initially saw an opportunity to expand our platform and cater to therapists who accept insurance, our findings highlighted significant challenges.

One of the biggest takeaways was that just because therapists want a better solution, it doesn’t mean they’re willing to switch. Billing is so deeply integrated into their workflows that even an outdated, frustrating system feels safer than something new.

That said, we did find one smaller opportunity. While we couldn’t manage full insurance billing, we could help therapists by automating the CMS-1500 form, pulling in client and session details to save them time. The actual submission and payment tracking, however, was beyond what we could realistically take on.

In the end, we made the right call to step away from insurance billing and focus on areas where we could create real impact.

For me, the biggest lesson was that sometimes, even if a problem is worth solving, it’s worth recognizing our real abilities to tackle it.

Note: I used AI to help organise and polish the writing in this case study. The research work, thinking, and decisions are entirely mine and no AI was involved in the research process.